Introduction

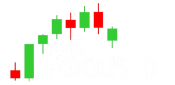

Trading is as much a mental game as it is a technical one. Even the most robust strategies fail without the right psychological discipline. Emotions like fear, greed, and frustration can derail decision-making, leading to overtrading, revenge trades, and blown accounts. This guide dives into the core principles of trading psychology, offering actionable steps to manage emotions, avoid overtrading, and learn from losses to build long-term success.

1. Understanding the Psychology of Trading

Why Emotions Destroy Trading Performance

- Fear: Causes hesitation, premature exits, or avoidance of valid setups.

- Greed: Leads to overtrading, ignoring risk management, or holding winners too long.

- FOMO (Fear of Missing Out): Drives impulsive entries into overextended markets.

- Revenge Trading: After a loss, traders often double down to “win back” money, compounding errors.

Example: A trader misses a profit target, watches the market reverse, and then exits in panic—only to see the price rebound. Emotional whiplash erodes confidence.

- How to Manage Emotions: Practical Strategies

A. Develop a Trading Plan (and Stick to It)

Define Rules: Entry/exit criteria, position sizing, and daily loss limits.

Backtest: Validate your strategy historically to build confidence in its edge.

Use Checklists: Review your plan before every trade to avoid impulsive decisions.

B. Embrace Mindfulness Techniques

Pre-Trade Rituals: Meditate, journal, or take deep breaths to center focus.

Post-Trade Reviews: Analyze decisions objectively, separating emotions from outcomes.

Accept Uncertainty: Markets are unpredictable; focus on process over results.

C. Cognitive Behavioral Techniques

Reframe Losses: View them as tuition for education, not failures.

Avoid Outcome Attachment: Celebrate disciplined trades, even if they lose.

2. How to Manage Emotions: Practical Strategies

A. Develop a Trading Plan (and Stick to It)

- Define Rules: Entry/exit criteria, position sizing, and daily loss limits.

- Backtest: Validate your strategy historically to build confidence in its edge.

- Use Checklists: Review your plan before every trade to avoid impulsive decisions.

B. Embrace Mindfulness Techniques

- Pre-Trade Rituals: Meditate, journal, or take deep breaths to center focus.

- Post-Trade Reviews: Analyze decisions objectively, separating emotions from outcomes.

- Accept Uncertainty: Markets are unpredictable; focus on process over results.

C. Cognitive Behavioral Techniques

B. Embrace Mindfulness Techniques

- Pre-Trade Rituals: Meditate, journal, or take deep breaths to center focus.

- Post-Trade Reviews: Analyze decisions objectively, separating emotions from outcomes.

- Accept Uncertainty: Markets are unpredictable; focus on process over results.

C. Cognitive Behavioral Techniques

- Reframe Losses: View them as tuition for education, not failures.

- Avoid Outcome Attachment: Celebrate disciplined trades, even if they lose.

- Practice Gratitude: Reflect on progress to counter negativity bias.

3. Avoiding Overtrading: Discipline Over Activity

Why Traders Overtrade

- Boredom during slow markets.

- Chasing validation (“I need to be right”).

- Misinterpreting frequency as productivity.

Solutions to Curb Overtrading

- Set Daily Trade Limits: Cap the number of trades (e.g., 3–5/day).

- Wait for High-Probability Setups: Only trade when your strategy’s criteria are met.

- Track Metrics: Monitor win rate, risk-reward ratios, and average profit/loss. If your edge requires 2–3 trades a week, avoid forcing 10.

Case Study: A forex trader reduced trades from 20 to 5 per week by focusing only on pin bar reversals at key support/resistance levels. Their profitability tripled.

4. Learning from Losses: The Path to Growth

A. Analyze Losses Objectively

- Journaling: Document:

- Market conditions during the loss.

- Emotional state (e.g., “Felt rushed after missing the morning session”).

- Deviations from your plan.

- Categorize Losses:

- Good Losses: Followed your plan but didn’t work out (no guilt needed).

- Bad Losses: Caused by rule violations (e.g., ignoring stop-loss).

B. Build a Loss Recovery Protocol

- Step 1: Pause trading after two consecutive losses.

- Step 2: Review your journal to identify patterns (e.g., overtrading during news events).

- Step 3: Adjust your strategy or rules (e.g., avoid trading during high-impact news).

C. Adopt a Growth Mindset

- Ask “What Can I Learn?”: Instead of “Why did I lose?”

- Normalize Losses: Even top traders have 40–60% win rates.

- Focus on Consistency: Small, steady gains compound over time.

5. Real-Life Scenarios: Applying Psychological Tools

Scenario 1: Fear of Pulling the Trigger

- Problem: A trader hesitates on valid entries due to past losses.

- Fix: Trade smaller sizes or use a demo account to rebuild confidence.

Scenario 2: Revenge Trading After a Loss

- Problem: A trader loses 500andimpulsivelyrisks500andimpulsivelyrisks1,000 to recover.

- Fix: Set a daily loss limit (e.g., 3% of account) and walk away when hit.

Scenario 3: Overtrading in Choppy Markets

- Problem: A trader forces trades during low-volatility periods.

- Fix: Switch to higher timeframes (e.g., 4-hour charts) or stay sidelined.

6. Tools and Habits for Mental Resilience

- Trading Journal Apps: TraderSync, Edgewonk.

- Mindfulness Apps: Headspace, Calm.

- Accountability Partners: Share goals with a mentor or trading community.

- Routine Building: Start each session with a warm-up (e.g., reviewing charts).

7. Common Psychological Traps (and How to Escape Them)

| Trap | Solution |

|---|---|

| Confirmation Bias | Seek disconfirming evidence for trades. |

| Anchoring | Avoid fixating on entry prices; focus on price action. |

| Overconfidence | Review past losses to stay humble. |

8. FAQs on Trading Psychology

Q: How do I stop feeling angry after a loss?

A: Reframe the loss as feedback. Ask: “Did I follow my plan? What can I improve?”

Q: Why do I sabotage my own trades?

A: Self-sabotage often stems from fear of success or imposter syndrome. Work on self-worth outside trading.

Q: How long does it take to master trading psychology?

A: It’s a lifelong journey, but consistent practice can yield improvements in 3–6 months.

Conclusion

Trading psychology separates profitable traders from the rest. By mastering emotional regulation, avoiding overtrading, and treating losses as lessons, you’ll build the mental stamina needed to thrive in volatile markets. Remember: Discipline today compounds into freedom tomorrow.

Final Tip: Print your trading rules and place them near your screen. When emotions surge, let your plan—not your feelings—drive decisions.