The foreign exchange market, commonly known as Forex or FX, is the largest and most liquid financial market in the world. With a staggering daily trading volume exceeding $7.5 trillion (as of 2023), it dwarfs stock markets, commodities, and even cryptocurrencies. But what exactly is Forex trading, and why does it matter to everyone—from governments and multinational corporations to everyday investors? In this comprehensive guide, we’ll explore the mechanics of the Forex market, its role in global commerce, and how individuals can navigate its opportunities and risks.

1. What is Forex Trading?

At its core, Forex trading is the act of buying one currency while simultaneously selling another. Currencies are traded in pairs, such as EUR/USD (Euro/US Dollar) or GBP/JPY (British Pound/Japanese Yen). The goal is simple: profit from fluctuations in exchange rates. For example, if you believe the Euro will strengthen against the US Dollar, you might buy EUR/USD. If the exchange rate rises, you sell the pair later for a profit.

Currency Pairs Explained

Every Forex transaction involves two currencies:

- Base Currency: The first currency in the pair (e.g., EUR in EUR/USD).

- Quote Currency: The second currency (e.g., USD in EUR/USD).

The exchange rate tells you how much of the quote currency is needed to buy one unit of the base currency. If EUR/USD is priced at 1.20, it means 1 Euro equals 1.20 US Dollars.

Major Pairs: These involve the US Dollar and other dominant currencies (e.g., EUR/USD, USD/JPY).

Minor Pairs: Exclude the USD but include other major currencies (e.g., EUR/GBP).

Exotic Pairs: Pair a major currency with one from an emerging economy (e.g., USD/TRY, USD/ZAR).

2. How the Forex Market Operates: Structure and Participants

Unlike stock markets, which have centralized exchanges like the NYSE or Nasdaq, Forex is a decentralized over-the-counter (OTC) market. Transactions occur electronically between banks, brokers, and traders across the globe. Here’s how it works:

A 24-Hour Global Marketplace

The Forex market operates 24 hours a day, five days a week, thanks to overlapping trading sessions across key financial hubs:

- Sydney: Opens at 5 PM EST.

- Tokyo: Opens at 7 PM EST.

- London: Opens at 3 AM EST.

- New York: Opens at 8 AM EST.

This non-stop cycle ensures constant liquidity, allowing traders to react instantly to news, economic data, or geopolitical events.

Key Market Participants

- Central Banks: Entities like the Federal Reserve (Fed) or European Central Bank (ECB) influence Forex through monetary policy, interest rates, and currency interventions.

- Commercial Banks: Major players like JPMorgan or Deutsche Bank facilitate bulk transactions for clients and trade for their own accounts.

- Corporations: Multinational companies hedge currency risk when operating overseas (e.g., Apple converting USD profits to EUR for European operations).

- Institutional Investors: Hedge funds and pension funds trade currencies to diversify portfolios.

- Retail Traders: Individual traders like you and me, accessing the market via online brokers.

3. Why Forex Matters: Its Global Significance

The Forex market isn’t just about speculation—it’s the backbone of international trade and investment. Here’s why it’s indispensable:

Enabling Global Commerce

Imagine a German car manufacturer exporting vehicles to the U.S. The company receives payment in USD but needs EUR to pay its employees and suppliers. Forex markets make this conversion seamless. Without them, cross-border trade would grind to a halt.

Economic Stability and Competitiveness

Exchange rates directly impact a country’s economy:

- A weaker currency makes exports cheaper, boosting industries (e.g., Japan’s yen depreciation aiding Toyota).

- A stronger currency lowers import costs, reducing inflation (e.g., the US benefiting from cheap Chinese goods).

Central banks often intervene to stabilize currencies. For instance, Switzerland’s central bank capped the Franc’s value in 2011 to protect exporters.

A Barometer of Global Sentiment

Forex markets react swiftly to geopolitical events. When Brexit uncertainty loomed, the British Pound (GBP) plummeted. During the COVID-19 pandemic, the US Dollar surged as investors sought safe-haven assets. Traders analyze currencies to gauge global risk appetite.

4. Key Drivers of Exchange Rates

Understanding what moves currency prices is critical for traders. Here are the primary factors:

1. Interest Rates

Currencies from countries with higher interest rates often attract foreign capital, driving up demand. For example, if the Fed raises rates while the ECB holds steady, the USD typically strengthens against the EUR.

2. Economic Indicators

- GDP Growth: Strong growth signals a healthy economy, boosting the currency.

- Inflation: Moderate inflation is positive, but hyperinflation erodes currency value (e.g., Venezuela’s Bolívar).

- Employment Data: Low unemployment in the U.S. often strengthens the USD.

3. Political Stability

Investors flock to stable economies. Political turmoil, like coups or trade wars, can trigger capital flight. The Turkish Lira (TRY) has suffered during periods of domestic unrest.

4. Market Sentiment

Risk-on environments favor “commodity currencies” like the Australian Dollar (AUD), while safe-haven currencies (USD, JPY, CHF) rise during crises.

5. How to Trade Forex: Strategies and Tools

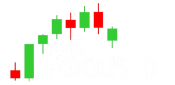

Popular Trading Styles

- Day Trading: Opening and closing positions within a single day to capitalize on short-term volatility.

- Swing Trading: Holding trades for days or weeks based on technical patterns.

- Position Trading: Long-term bets on macroeconomic trends (e.g., buying USD if the Fed plans rate hikes).

Technical vs. Fundamental Analysis

- Technical Traders: Use charts, indicators (e.g., moving averages, RSI), and patterns to predict price movements.

- Fundamental Traders: Focus on economic data, news, and geopolitical events.

Leverage: A Double-Edged Sword

Forex brokers offer leverage (e.g., 50:1 or 100:1), letting traders control large positions with minimal capital. While this amplifies profits, it also magnifies losses. Risk management tools like stop-loss orders are essential.

6. Risks and Challenges in Forex Trading

Volatility

Currencies can swing wildly due to unexpected news. For example, the Swiss Franc (CHF) surged 30% in minutes in 2015 when the Swiss National Bank abandoned its Euro peg.

Leverage Risks

Over-leveraging can wipe out accounts quickly. A 1% move against a 100:1 leveraged position results in a 100% loss.

Regulatory Concerns

The Forex market’s OTC nature makes it prone to scams. Always choose brokers regulated by authorities like the FCA (UK) or ASIC (Australia).

7. Technology’s Role in Democratizing Forex

Advances in fintech have transformed Forex trading:

- Retail Platforms: Tools like MetaTrader 4/5 and TradingView allow individuals to trade from smartphones.

- Algorithmic Trading: Bots execute trades based on pre-set rules, eliminating emotional bias.

- Social Trading: Platforms like eToro let users copy the trades of experts.

8. How to Get Started in Forex Trading

- Educate Yourself: Master the basics of currency pairs, leverage, and analysis.

- Choose a Reputable Broker: Look for low spreads, robust regulation, and user-friendly platforms.

- Start with a Demo Account: Practice risk-free before committing real money.

- Develop a Trading Plan: Define your goals, risk tolerance, and strategies.

9. The Future of Forex: Trends to Watch

- Cryptocurrency Integration: Bitcoin and stablecoins are increasingly traded alongside fiat currencies.

- Central Bank Digital Currencies (CBDCs): Digital versions of national currencies could reshape Forex liquidity.

- AI and Machine Learning: Predictive algorithms are becoming smarter at analyzing market data.

Conclusion: The Forex Market’s Enduring Relevance

Forex trading is more than a financial niche—it’s the lifeblood of global economics. From enabling international trade to offering lucrative opportunities for traders, its impact is unparalleled. However, success in Forex demands discipline, continuous learning, and respect for its risks. Whether you’re a corporation hedging currency exposure or an individual speculating on price swings, understanding Forex is key to navigating today’s interconnected financial world.

By staying informed and adopting prudent strategies, anyone can participate in this dynamic market. Just remember: in Forex, knowledge isn’t just power—it’s profit.