Forex trading, the world’s largest financial market, offers opportunities for traders of all budgets—even those starting with just $100. While $100 may seem like a modest amount, it’s enough to begin your journey into currency trading if approached strategically. This guide will walk you through the essentials of starting Forex trading with limited capital, emphasizing risk management, education, and disciplined execution.

1. Understanding Forex Trading: The Basics

Forex (foreign exchange) trading involves buying and selling currency pairs (e.g., EUR/USD, GBP/JPY) to profit from fluctuations in exchange rates. The market operates 24/5, with over $7 trillion traded daily, offering high liquidity and accessibility.

Key Terms to Know:

- Currency Pairs: Base currency (first) vs. quote currency (second). Example: In EUR/USD, EUR is the base, USD is the quote.

- Pips: The smallest price movement (e.g., 0.0001 for most pairs).

- Leverage: Borrowed capital to amplify positions (e.g., 50:1 means 50controlledforevery50controlledforevery1 invested).

- Margin: The collateral required to open a leveraged position.

**Why Start with 100?∗∗While100?∗∗While100 is a small sum, it allows you to:

- Gain hands-on experience without significant financial risk.

- Learn risk management and strategy development.

- Trade micro lots (1,000 units) to minimize per-trade exposure.

2. Step 1: Educate Yourself Before Trading

Education is the foundation of successful trading. Jumping into Forex without understanding its mechanics is akin to gambling.

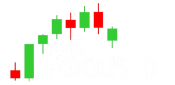

A. Learn Technical Analysis

Study price charts, trends, and indicators like:

- Moving Averages (identify trends).

- RSI (Relative Strength Index) to spot overbought/oversold conditions.

- Support/Resistance Levels (price floors/ceilings).

B. Master Fundamental Analysis

Economic events (e.g., interest rate decisions, GDP reports) impact currency values. Use tools like the Forex Factory Calendar to track news releases.

C. Explore Trading Strategies

- Swing Trading: Hold trades for days to capture medium-term trends.

- Day Trading: Close positions before the market closes to avoid overnight risks.

- Position Trading: Long-term trades based on macroeconomic trends.

Recommended Resources:

- BabyPips’ “School of Pipsology” (free beginner course).

- Books: “Currency Trading for Dummies” by Kathleen Brooks.

- YouTube channels like The Trading Channel or Rayner Teo.

3. Step 2: Choose a Reliable, Low-Cost Broker

Your broker is your gateway to the market. Prioritize safety, low costs, and user-friendly platforms.

Criteria for Selecting a Broker:

- Regulation: Ensure oversight by authorities like the FCA (UK), ASIC (Australia), or CySEC (Cyprus).

- Minimum Deposit: Brokers like Deriv, and Exness allow accounts with $100 or less.

- Micro Lots: Confirm the broker supports 0.01-lot trades (1,000 units).

- Spreads & Commissions: Opt for brokers with tight spreads (difference between bid/ask prices).

Avoid Unregulated Brokers:

Scams are rampant in Forex. Always verify regulatory status on the broker’s website or through official databases.

4. Step 3: Practice with a Demo Account

A demo account lets you trade with virtual money, mimicking real-market conditions. Use it to:

- Test strategies without financial risk.

- Familiarize yourself with the trading platform (e.g., MetaTrader 4/5).

- Develop emotional discipline (e.g., handling losses).

How Long to Practice?

Spend 1–3 months on a demo account. Treat it like a real account—track performance and refine your approach.

5. Step 4: Craft a Risk Management Strategy

Risk management separates successful traders from those who blow their accounts.

Rules to Follow:

- Risk 1–2% Per Trade: With 100,riskonly100,riskonly1–$2 per trade.

- Use Stop-Loss Orders: Automatically exit losing trades to prevent emotional decisions.

- Limit Leverage: High leverage (e.g., 500:1) can wipe out your account. Stick to 10:1 or 20:1.

- Avoid Overtrading: Focus on quality setups, not quantity.

Example:

If trading EUR/USD with a 0.01 lot:

- Each pip = ~$0.10.

- A 10-pip stop-loss = 1risk(11risk(1100).

6. Step 5: Start Trading Live with $100

Once prepared, transition to a live account with these steps:

A. Trade Micro Lots

Stick to 0.01-lot positions to keep risk minimal.

B. Focus on Major Currency Pairs

Majors like EUR/USD and USD/JPY have tight spreads and high liquidity, reducing transaction costs.

C. Keep It Simple

Avoid complex strategies initially. Master one approach (e.g., trend-following with moving averages).

Sample Trade Setup:

- Currency Pair: EUR/USD

- Entry: Buy at 1.0800 if price breaks above a resistance level.

- Stop-Loss: 1.0790 (10 pips = $1 risk).

- Take Profit: 1.0830 (30 pips = $3 profit).

7. Step 6: Develop a Trading Plan

A trading plan is your roadmap. Include:

- Strategy: Entry/exit rules, timeframes, and indicators.

- Risk Parameters: Maximum daily loss (e.g., 5% of capital).

- Trading Hours: Align with sessions (London, New York) for volatility.

Stick to the Plan:

Emotions like fear and greed lead to impulsive decisions. Document every trade to identify strengths/weaknesses.

8. Step 7: Monitor and Optimize Performance

A. Review Trades Weekly

Analyze winning and losing trades. Did you follow your plan? What external factors (e.g., news) influenced outcomes?

B. Compounding Profits

Reinvest gains gradually. Growing a 100accountto100accountto200 requires a 100% return, but growing 200to200to400 is the same effort.

C. Adjust Strategies

Markets evolve. Stay flexible—adapt to changing conditions without abandoning your core rules.

9. Common Pitfalls to Avoid

- Overleveraging: Even a small loss can wipe out your account with excessive leverage.

- Ignoring News Events: Economic reports can trigger volatility. Always check the calendar.

- Chasing Losses: Revenge trading after a loss often leads to bigger losses.

10. Tools to Enhance Your Trading

- MetaTrader 4/5: Industry-standard platforms for charting and execution.

- TradingView: Advanced charting tools and social trading ideas.

- Myfxbook: Track performance and compare strategies.

11. Realistic Expectations

Forex trading isn’t a “get-rich-quick” scheme. With $100:

- Aim for 1–5% monthly returns (1–1–5 profit).

- Focus on consistency, not overnight success.

Conclusion: Building a Sustainable Trading Career

Starting Forex trading with $100 is a journey of patience and discipline. Prioritize education, risk management, and incremental growth. Over time, the skills you develop can scale with larger accounts. Remember, every professional trader started as a beginner—what sets them apart is their commitment to continuous learning and emotional control.

By following this guide, you’ll lay a strong foundation for long-term success in the Forex market. Stay humble, stay disciplined, and let compound growth work in your favor.