Introduction to Proprietary Trading Firms

Proprietary trading firms, or “prop firms,” are companies that provide traders with capital to trade financial markets in exchange for a share of the profits. Unlike retail trading, where individuals use their own funds, prop traders leverage the firm’s capital to amplify their potential returns. These firms operate across asset classes, including forex, stocks, commodities, indices, and cryptocurrencies.

. How Prop Firms Operate: Business Models and Structures

Types of Proprietary Trading Firms

Prop firms fall into two broad categories:

- Traditional Prop Firms

- Structure: These firms often require traders to work on-site (e.g., in major financial hubs like Chicago or New York).

- Requirements: They typically recruit experienced traders with proven track records, advanced degrees, or certifications (e.g., Series 7/63 licenses).

- Capital Allocation: Traders receive capital based on performance and seniority. Profit splits are negotiable but often favor the firm (e.g., 50/50).

- Examples: Jane Street, DRW, Optiver.

- Online Prop Firms

- Structure: Remote and accessible globally. Traders pay a fee to participate in evaluation challenges.

- Requirements: No formal credentials needed. Success depends on passing a trading challenge with profit targets and risk limits.

- Capital Allocation: Traders earn profit splits (70–90%) after passing evaluations.

- Examples: FTMO, The5ers, MyForexFunds, SurgeTrader.

Revenue Streams for Prop Firms

Prop firms generate income through:

- Evaluation Fees: Traders pay upfront fees (100–100–1,000) to participate in challenges.

- Profit Splits: Firms retain 10–30% of profits generated by funded traders.

- Account Resets: Traders pay additional fees to retake failed challenges.

2. The Evaluation Process: Breaking Down the Challenge

Most online prop firms require traders to pass a 2-phase evaluation:

Phase 1: The Initial Challenge

- Profit Target: Achieve 8–10% profit within 30 days.

- Risk Limits:

- Daily Loss Limit: 5% of the account balance.

- Maximum Drawdown: 10% (total loss from the account’s peak balance).

- Trading Rules:

- Minimum trading days (e.g., 10 days) to prevent “lucky” trades.

- Restrictions on overnight positions or high-frequency trading.

Phase 2: Verification

- Profit Target: A smaller target (5–8%) over another 30–60 days.

- Stricter Monitoring: Firms assess consistency and adherence to rules.

Example: FTMO’s Challenge Structure

- Phase 1: 10% profit target, 10% max drawdown, 30 days.

- Phase 2: 5% profit target, same drawdown, 60 days.

- Fee: €€500 for a $100,000 account.

3. Risk Management: The Key to Survival

Prop firms prioritize capital preservation. Violating risk rules results in immediate disqualification.

Critical Risk Rules

- Daily Loss Limit: If your account starts at 100,000,a5100,000,a55,000 in a day.

- Maximum Drawdown: A 10% drawdown on a 100,000accountmeansyoucannotletyourbalancefallbelow100,000accountmeansyoucannotletyourbalancefallbelow90,000.

- Trailing Drawdown: Some firms use a trailing drawdown, where the max loss threshold “trails” your account’s peak balance.

Risk Management Strategies

- Position Sizing: Risk 1–2% of your account per trade.

- Stop-Loss Orders: Set stop-losses for every trade to limit downside.

- Avoid Over-Leverage: Even with 1:100 leverage, overexposing your account can trigger drawdown violations.

4. Profit Targets and Trading Strategies

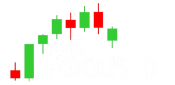

Choosing the Right Strategy

Prop firms favor consistency over high-risk, high-reward approaches.

- Swing Trading: Hold positions for days to capture medium-term trends.

- Pros: Less time-intensive, avoids intraday volatility.

- Cons: Requires patience and tolerance for overnight risk.

- Day Trading: Close all positions by the end of the day.

- Pros: No overnight risk, aligns with prop firm rules.

- Cons: Emotionally taxing; requires quick decision-making.

- Scalping: Profit from small price movements (e.g., 5–10 pips).

- Pros: Frequent opportunities.

- Cons: High commission costs, often restricted by prop firms.

Avoid Restricted Strategies

- High-Frequency Trading (HFT): Banned due to latency and infrastructure advantages.

- Martingale Systems: Doubling down on losses violates risk rules.

- News Trading: Some firms prohibit trading during major economic releases (e.g., NFP, FOMC).

5. Psychological Discipline: Mastering the Mental Game

Trading psychology is the difference between passing and failing.

Common Psychological Traps

- Revenge Trading: Chasing losses after a bad trade.

- Overconfidence: Taking oversized risks after a winning streak.

- Fear of Missing Out (FOMO): Entering trades without a plan.

Tips for Mental Resilience

- Stick to Your Plan: Follow your trading strategy, even during drawdowns.

- Take Breaks: Step away after consecutive losses to reset emotionally.

- Journaling: Document trades to identify emotional patterns.

6. Preparing for the Challenge: Practice and Preparation

Demo Trading

Simulate prop firm conditions:

- Use the same leverage, lot sizes, and profit targets.

- Test strategies in volatile market conditions (e.g., during news events).

Backtesting

Use historical data to validate your strategy’s performance. Tools like TradingView or MetaTrader’s Strategy Tester can help.

Common Mistakes to Avoid

- Overtrading: Taking too many trades to hit profit targets.

- Ignoring Slippage: Fast markets can widen spreads, increasing losses.

- Neglecting Time Zones: Trade during high-liquidity sessions (e.g., London/New York overlap).

7. Post-Challenge: Scaling and Long-Term Success

Profit Splits and Withdrawals

- Most firms offer 70–90% profit splits.

- Withdrawals are processed monthly or bi-weekly.

Scaling Plans

Firms like The5ers increase your capital automatically after hitting profit milestones. For example:

- Start with $100,000.

- Reach 10,000profit→scaleto10,000profit→scaleto200,000.

Ongoing Requirements

- Maintain consistency: Firms monitor performance and may reduce capital for repeated losses.

- Stay updated: Attend webinars or use firm-provided coaching.

8. Risks and Red Flags

Avoiding Scams

- Transparency: Legitimate firms clearly outline rules and fees.

- Regulatory Compliance: Check if the firm is registered with financial authorities (e.g., FCA, CySEC).

- Reviews: Research user experiences on forums like Reddit or Trustpilot.

Tax Implications

Prop traders are typically classified as independent contractors. Consult a tax professional to report earnings accurately.

9. Final Tips for Passing Prop Firm Challenges

- Start Small: Begin with a $10,000 challenge to minimize fees and pressure.

- Focus on Survival: Hitting profit targets is secondary to avoiding rule violations.

- Network: Join prop firm communities (e.g., Discord groups) for support.

Conclusion

Proprietary trading firms offer a structured path to trading larger capital, but success demands discipline, strategic planning, and emotional control. By mastering risk management, refining a consistent strategy, and treating evaluations as a professional endeavor, traders can unlock lucrative opportunities in global markets. Whether you’re a novice or an experienced trader, prop firms provide a platform to scale your skills—provided you respect the rules and stay resilient.