Introduction

The foreign exchange (forex) market, with its colossal daily trading volume of over $6 trillion, is the backbone of international trade and finance. At its core lies price action trading—a strategy that relies on interpreting raw price movements to predict future trends. This article delves into how mastering price action trading not only equips traders with actionable insights but also fuels the global economy by fostering liquidity, stability, and efficient resource allocation.

Section 1: Understanding Price Action Trading

1.1 What is Price Action Trading?

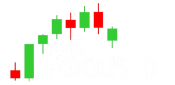

Price action trading is a methodology that prioritizes historical price data over technical indicators. By analyzing patterns like candlesticks, trends, and support/resistance levels, traders decode market psychology and supply-demand imbalances. For instance, a “bearish pin bar” at a resistance level often signals a potential reversal, offering a tactical entry point.

1.2 Core Principles

- Market Sentiment Over Indicators: Prices reflect collective human behavior, not just algorithms.

- Key Levels Matter: Resistance zones become battlegrounds for buyers and sellers.

- Simplicity Wins: Less clutter from indicators means clearer decision-making.

1.3 Tools of the Trade

- Candlestick Patterns: Engulfing patterns, spinning tops, and marubozu candles.

- Chart Patterns: Ascending triangles (bullish), descending channels (bearish).

Example: In 2023, the USD/JPY surged after breaking a multi-month consolidation range, rewarding traders who recognized the bullish breakout.

Section 2: The Global Currency Market – Structure and Significance

2.1 The Forex Ecosystem

- Key Players: Central banks (setting monetary policy), corporations (hedging risks), and retail traders.

- Trading Sessions: Overlapping hours (e.g., London-New York) drive peak volatility.

- Currency Pairs: Exotic pairs like USD/TRY offer high risk-reward opportunities.

2.2 Economic Implications of Exchange Rates

- Trade Balances: A weaker currency can boost exports (e.g., China’s yuan management).

- Inflation Control: Central banks intervene to stabilize purchasing power (e.g., India’s RBI).

- Capital Flight: Investors flee unstable currencies, as seen in Argentina’s peso crisis (2018).

Case Study: The Brexit referendum (2016) triggered a 10% GBP/USD plunge overnight, disrupting EU-UK trade agreements.

Section 3: Price Action Trading’s Role in Market Efficiency

3.1 Liquidity and Fair Pricing

Active traders narrow bid-ask spreads, allowing businesses to hedge efficiently. For example, Amazon hedges billions in foreign revenue using liquid forex markets.

3.2 Real-Time News Integration

Price action traders absorb events like Fed rate decisions instantly. When Russia invaded Ukraine in 2022, EUR/USD dropped 3% in hours as traders priced in energy risks.

3.3 Risk Mitigation for Corporations

Hedging tools like forward contracts rely on stable markets. A chocolate manufacturer in Switzerland, for instance, might hedge EUR/CHF exposure to protect against euro depreciation.

Section 4: Macroeconomic Impacts of Forex Markets

4.1 Trade and Investment Flows

Stable exchange rates attract foreign direct investment (FDI). Vietnam’s dong stability, for example, helped it become a manufacturing hub for Samsung and Nike.

4.2 Central Bank Policies

Currency wars occur when nations devalue competitively. Japan’s yen interventions in 2022 aimed to counter USD strength and protect export margins.

4.3 Speculation’s Dual Role

While excessive speculation can destabilize (e.g., 1997 Asian Financial Crisis), it also provides liquidity. George Soros’ 1992 bet against the GBP exposed structural flaws in the ERM system.

Section 5: Challenges and Ethical Considerations

5.1 Black Swan Events

The 2015 Swiss Franc shock erased $1 trillion in global markets overnight, highlighting the risks of overleveraged trades.

5.2 Retail Trader Vulnerabilities

Social media-driven “pump and dump” schemes, like the 2021 South African rand volatility, often trap inexperienced traders.

5.3 Regulatory Responses

Measures like the CFTC’s position limits in the U.S. aim to curb market manipulation while preserving liquidity.

Section 6: Strategies for Mastering Price Action Trading

6.1 Blending Technicals and Fundamentals

Monitor macroeconomic calendars for events like Non-Farm Payrolls. A head-and-shoulders pattern during a Fed meeting week could signal a USD reversal.

6.2 Discipline and Risk Management

- Use trailing stops to lock in profits.

- Avoid revenge trading after losses.

6.3 Continuous Learning

Study historical crises (e.g., 2008 Financial Crisis) to recognize recurring patterns like flight-to-safety USD rallies.

Conclusion

Price action trading is more than a skill—it’s a critical component of global economic infrastructure. By enhancing liquidity, enabling risk management, and reflecting real-time macroeconomic shifts, traders contribute to a interconnected financial system. As digital assets and AI-driven algorithms reshape forex markets, mastering price action remains indispensable for navigating volatility and driving sustainable growth.