Introduction

The world of online trading is booming—but so are scams and unreliable platforms. Choosing a broker like Deriv (formerly Binary.com) can be a smart move, but only if you know how to navigate the process safely. In this guide, you’ll learn:

- How to open a Deriv trading account in 5 simple steps.

- Red flags to spot shady brokers.

- Pro tips to protect your funds and trade with confidence.

Let’s get started!

Step 1: Research & Verify Your Broker

Before signing up, ensure your broker is regulated and trustworthy. Here’s how:

Check Regulation

- Deriv is regulated by top authorities like the Malta Financial Services Authority (MFSA) and Vanuatu Financial Services Commission (VFSC).

- Always verify a broker’s license on official websites (e.g., FCA, ASIC, CySEC).

Read Reviews

- Look for unbiased user reviews on platforms like Trustpilot or Forex Peace Army.

- Avoid brokers with complaints about withdrawals or hidden fees.

Avoid These Red Flags

🚩 “Guaranteed Profits”: No legitimate broker promises risk-free gains.

🚩 No Physical Address: Scammers often hide their location.

🚩 Pressure to Deposit Quickly: Reputable brokers give you time to decide.

Step 2: Open Your Deriv Trading Account

Follow these steps to create your Deriv account:

- CLICK HERE TO OPEN A DERIV ACCOUNT to avoid phishing sites.

- Click “Create Free Account”: Fill in your email, password, and country of residence.

- Verify Your Email: Confirm via the link sent to your inbox.

- Complete KYC (Know Your Customer): Upload ID (passport, driver’s license) and proof of address (utility bill).

- Choose Your Account Type: Pick between a real account (funded) or demo account (practice with virtual funds).

Why Deriv?

- Offers 100+ tradable assets (forex, commodities, cryptocurrencies).

- User-friendly platforms (Deriv MT5, Deriv Trader).

- Free demo account to test strategies risk-free.

Step 3: Fund Your Account Securely

Deposit funds using safe payment methods:

- Credit/Debit Cards: Instant processing, but may have fees.

- E-Wallets: Skrill, Neteller, or cryptocurrencies (Bitcoin, Ethereum).

- Bank Transfers: Secure but slower (1-5 business days).

Safety Tips:

- Never share your card details via email or unsecured channels.

- Start with a small deposit to test withdrawals later.

Step 4: Avoid Scams: Protect Your Money

Even regulated platforms require vigilance. Here’s how to stay safe:

Common Trading Scams

- Fake Brokers: Clones of legitimate sites with slightly altered URLs (e.g., “Derivv.com”).

- Signal Seller Fraud: “Experts” selling worthless trade alerts.

- Phishing Emails: Fake “account verification” links to steal login details.

How to Stay Protected

- Enable two-factor authentication (2FA) on your Deriv account.

- Use strong, unique passwords.

- Withdraw profits regularly to limit exposure.

Step 5: Start Trading Responsibly

Now that your account is set up:

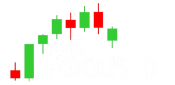

- Practice First: Use Deriv’s demo account to master the platform.

- Learn Risk Management:

- Set stop-loss orders to limit losses.

- Never risk more than 1-2% of your capital per trade.

- Stay Informed: Follow market news on Deriv’s economic calendar.