Introduction

The Forex market sees over $6.6 trillion traded daily, but only 10% of traders succeed long-term. Why? The difference lies in having a structured trading strategy. Without a plan, even the luckiest wins can turn into devastating losses. This 1500-word guide breaks down how to build a Forex trading strategy tailored to your goals, risk tolerance, and lifestyle. Whether you’re a day trader, swing trader, or investing for the long haul, you’ll learn actionable steps to trade confidently and consistently.

Introduction

The Forex market sees over $6.6 trillion traded daily, but only 10% of traders succeed long-term. Why? The difference lies in having a structured trading strategy. Without a plan, even the luckiest wins can turn into devastating losses. This 1500-word guide breaks down how to build a Forex trading strategy tailored to your goals, risk tolerance, and lifestyle. Whether you’re a day trader, swing trader, or investing for the long haul, you’ll learn actionable steps to trade confidently and consistently.

1. Understanding the Forex Market

Before crafting a strategy, grasp the market’s mechanics:

How Forex Works

- Currencies trade in pairs (e.g., EUR/USD, GBP/JPY).

- Prices fluctuate based on supply/demand, economic data, and geopolitical events.

- The market operates 24/5 across four major sessions: Sydney, Tokyo, London, New York.

Key Participants

- Banks & Institutions: Drive liquidity (70% of volume).

- Retail Traders: Individuals like you, often using leverage.

- Central Banks: Influence rates (e.g., Fed, ECB).

Why This Matters: Your strategy must adapt to market hours, liquidity, and news cycles.

2. Types of Forex Trading Strategies

Choose a style that aligns with your personality and schedule:

| Strategy | Timeframe | Best For | Risk Level |

|---|---|---|---|

| Scalping | Seconds/Minutes | Quick, decisive traders | High |

| Day Trading | Hours | Full-time focus | Moderate |

| Swing Trading | Days | Part-time flexibility | Moderate |

| Position Trading | Weeks/Months | Patient investors | Low |

Example: A swing trader might hold EUR/USD for 3 days to capitalize on ECB interest rate rumors.

3. Step 1: Define Your Goals & Risk Tolerance

A strategy without clear goals is like sailing without a compass. Ask yourself:

Questions to Clarify Goals

- Are you trading for income, wealth growth, or hedging?

- How much time can you dedicate daily/weekly?

- What’s your maximum acceptable loss per trade (e.g., 1-2% of capital)?

Risk Tolerance Assessment:

- Conservative: Prefer low leverage and stable pairs (e.g., USD/CHF).

- Aggressive: Comfortable with exotics (e.g., USD/ZAR) and high leverage.

4. Step 2: Choose Your Analytical Approach

Two primary methods shape strategies:

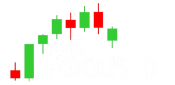

Technical Analysis

- What It Is: Using charts, indicators, and patterns to predict price movements.

- Tools:

- Moving Averages: Identify trends (e.g., 50-day vs. 200-day crossover).

- RSI (Relative Strength Index): Spot overbought/oversold conditions.

- Fibonacci Retracement: Predict support/resistance levels.

Example Strategy: Buy GBP/USD when the price bounces off Fibonacci 61.8% support with RSI < 30.

Fundamental Analysis

- What It Is: Analyzing economic data (GDP, inflation) and central bank policies.

- Key Indicators:

- Non-Farm Payrolls (NFP): Impacts USD volatility.

- Interest Rate Decisions: Central bank hikes strengthen currencies.

Example Trade: Short EUR/USD if the Fed raises rates while ECB holds steady.

5. Step 3: Develop Entry & Exit Rules

A strategy lives and dies by its rules. Remove emotion with clear criteria.

Entry Triggers

- Breakout Entry: Enter when price crosses a key resistance level.

- Pullback Entry: Buy dips in an uptrend (e.g., 50-day MA bounce).

Exit Rules

- Take Profit: Set targets using risk-reward ratios (e.g., 1:2).

- Stop-Loss: Place below support (long trades) or above resistance (short trades).

Case Study:

- Entry: Buy USD/JPY at 110.00 after bullish MACD crossover.

- Stop-Loss: 109.50 (50 pips risk).

- Take Profit: 111.00 (100 pips reward → 1:2 RRR).

6. Step 4: Backtest & Optimize Your Strategy

Never deploy a strategy untested. Backtesting reveals flaws.

How to Backtest

- Manual Backtesting: Review historical charts (e.g., TradingView) and simulate trades.

- Automated Tools: Use MetaTrader’s Strategy Tester or platforms like FXBlue.

Metrics to Track:

- Win Rate: Percentage of profitable trades.

- Profit Factor: (Total Gains / Total Losses). Aim for >1.5.

- Max Drawdown: Largest peak-to-trough decline.

Optimization Tips:

- Adjust stop-loss distances or indicator parameters.

- Avoid overfitting (curve-fitting to past data).

7. Step 5: Implement Risk Management

Even the best strategies fail without risk controls.

The 1% Rule

Never risk more than 1% of your account per trade.

Formula:Position Size=Account RiskStop-Loss in Pips×Pip ValuePosition Size=Stop-Loss in Pips×Pip ValueAccount Risk

Example:

- Account: $10,000

- Risk: 1% = $100

- Stop-Loss: 50 pips

- Pip Value (EUR/USD): $10

- Position Size: 10050×10=0.2 lots50×10100=0.2 lots

8. Step 6: Keep a Trading Journal

Track every trade to refine your strategy.

What to Record:

- Date/Time, Currency Pair, Entry/Exit Prices.

- Reason for Entry (e.g., “Bullish pin bar at support”).

- Emotional State (e.g., “FOMO buy during news”).

Journal Tools:

- Spreadsheets: Customizable for metrics.

- Apps: TraderSync, Edgewonk.

9. Common Mistakes to Avoid

- Overtrading: Stick to high-probability setups.

- Ignoring News: Economic calendars prevent surprise volatility.

- Chasing Losses: Stick to your plan—revenge trading kills accounts.

Real-World Example: In 2021, traders ignoring the Swiss National Bank’s interventions in USD/CHF suffered massive losses.

10. Tools & Resources

- Charting Platforms: TradingView, MetaTrader 4/5.

- Economic Calendars: Forex Factory, Investing.com.

- Signal Services: Use cautiously (e.g., MQL5 Community).

FAQ

Q: How long does it take to build a profitable strategy?

A: 3-6 months of consistent testing and refinement.

Q: Can I copy someone else’s strategy?

A: You can, but personalize it to match your risk tolerance and schedule.

Q: Is automated trading better than manual?

A: Bots remove emotion but require coding skills. Manual trading offers flexibility.

Conclusion: From Theory to Profit

Building a Forex trading strategy is a journey—not a destination. Start small, backtest rigorously, and prioritize risk management. Remember, even the most profitable strategies face losses; consistency and discipline separate winners from the 90% who fail.