Introduction

In an era where financial markets are increasingly shaped by technology, Deriv Synthetic Indices have emerged as a groundbreaking innovation, redefining how traders engage with markets. Unlike traditional assets tied to real-world events or physical commodities, these indices exist purely in the digital realm, powered by advanced algorithms. This article explores the mechanics, advantages, and strategies behind Deriv Synthetic Indices, offering insights into why they’re becoming a cornerstone of modern trading.

What Are Deriv Synthetic Indices?

Deriv Synthetic Indices are algorithmically generated financial instruments designed to simulate market behavior. Created by Deriv, a leading online trading platform, these indices replicate price movements, volatility, and trends observed in real-world markets—but without relying on external factors like economic data or geopolitical events. Instead, their value is determined by complex mathematical models and random number generators.

Key characteristics include:

- Simulated Markets: Prices are generated in real-time by algorithms, ensuring a dynamic and unpredictable trading environment.

- Customizable Volatility: Traders can choose indices with varying volatility levels (e.g., “Volatility 10,” “Volatility 75”) to match their risk appetite.

- No Underlying Asset: Unlike stocks or forex, synthetic indices aren’t linked to physical commodities, companies, or currencies.

This unique framework makes them ideal for traders seeking flexibility, innovation, and freedom from traditional market constraints.

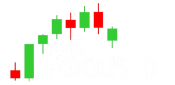

The Algorithmic Engine: How Synthetic Indices Work

At the core of Deriv Synthetic Indices lies a sophisticated algorithm that mimics real-market dynamics. Here’s a breakdown of its operation:

- Random Number Generation (RNG):

Prices are generated using cryptographically secure RNG systems, ensuring fairness and unpredictability. This eliminates manipulation risks and guarantees transparency. - Volatility Settings:

Each index is programmed with predefined volatility parameters. For example, “Volatility 100” experiences sharper price swings than “Volatility 10,” catering to both aggressive and conservative traders. - Time-Weighted Trends:

Algorithms incorporate time-based patterns to simulate bullish, bearish, or sideways markets, mirroring natural market cycles.

This blend of randomness and structure creates a realistic yet controlled trading experience.

24/7 Trading: Breaking Free from Market Hours

One of the most compelling features of Deriv Synthetic Indices is their 24/7 availability. Traditional markets like stocks or forex operate within fixed hours, limiting opportunities for traders in different time zones or those with unconventional schedules. Synthetic indices remove these barriers:

- Weekend Trading: While global markets close on weekends, synthetic indices remain active, enabling continuous strategy testing or profit-making.

- Holiday Accessibility: Economic calendars no longer dictate trading windows.

- Flexibility: Traders can react to simulated market movements at any hour, fostering a truly global user base.

This round-the-clock access is particularly valuable for part-time traders or those balancing other commitments.

No Real-World Dependency: A Self-Contained Ecosystem

Traditional assets like oil, gold, or Tesla stock are influenced by external forces—earnings reports, OPEC decisions, or inflation data. Synthetic indices, however, operate in a vacuum:

- Immunity to Global Events: Geopolitical crises or natural disasters don’t impact synthetic index prices.

- No Supply/Demand Dynamics: Prices aren’t swayed by production levels or consumer behavior.

- Predictable Volatility: Traders know the volatility level upfront, reducing surprises.

This detachment creates a level playing field, where success hinges solely on strategy, analysis, and timing.

Why Trade Synthetic Indices? Key Advantages

- Risk Management Control:

With predefined volatility, traders can align their positions with risk tolerance. For instance, a “Volatility 10” index offers steadier, less erratic movements for cautious strategies. - Diverse Opportunities:

Deriv offers multiple indices (e.g., Synthetic Volatility, Jump Indices, Range Break) to suit varying trading styles, from scalping to long-term trend analysis. - Lower Entry Barriers:

Unlike futures or forex, synthetic indices often require smaller capital commitments, making them accessible to beginners. - Practice Without Pressure:

Demo accounts allow traders to test strategies risk-free using virtual funds, building confidence before transitioning to live trading.

Trading Strategies for Synthetic Indices

To maximize success, traders employ tailored approaches:

1. Scalping

- Objective: Profit from small, frequent price movements.

- Best For: High-volatility indices (e.g., Volatility 75/100).

- Tools: Short-term charts (1- to 5-minute intervals), technical indicators like Bollinger Bands or RSI.

2. Swing Trading

- Objective: Capture trends over hours or days.

- Best For: Medium-volatility indices (e.g., Volatility 25/50).

- Tools: Fibonacci retracements, moving averages, and trendline analysis.

3. Risk Management Essentials

- Stop-Loss Orders: Automatically exit losing positions to limit downside.

- Position Sizing: Allocate only 1–2% of capital per trade to avoid overexposure.

- Volatility Alignment: Match trade duration to the index’s volatility (e.g., quick trades for high volatility).

Potential Drawbacks to Consider

- No Fundamental Analysis:

Since synthetic indices aren’t tied to real assets, traditional methods like earnings analysis or macroeconomic forecasting are irrelevant. - Emotional Discipline Required:

24/7 access can tempt traders to overtrade, leading to burnout or impulsive decisions. - Regulatory Differences:

Synthetic indices may fall under different regulations than traditional markets, depending on your region.

The Future of Algorithmic Trading

Deriv Synthetic Indices represent a paradigm shift in finance, blending technology with accessibility. As algorithms grow more sophisticated, expect features like:

- AI-Driven Predictive Models: Enhancing price simulation realism.

- Personalized Volatility Settings: Tailoring indices to individual preferences.

- Integration with Decentralized Finance (DeFi): Expanding liquidity and interoperability.

For forward-thinking traders, synthetic indices offer a glimpse into a future where markets are democratized, boundaries are erased, and innovation reigns supreme.

Conclusion

Deriv Synthetic Indices are more than a trading instrument—they’re a revolution. By combining algorithmic precision, 24/7 accessibility, and freedom from real-world unpredictability, they empower traders to operate on their own terms. Whether you’re a novice honing your skills or a seasoned pro exploring new avenues, synthetic indices provide a versatile, dynamic platform to thrive in the digital age. As technology continues to evolve, these indices will likely cement their place as a staple of modern trading, bridging the gap between imagination and opportunity.